UK Housing Market Faces Turbulence

UK house prices experienced their sharpest annual drop in 14 years last month, declining by 3.8%, as higher interest rates hindered potential buyers' ability to secure mortgages. The average price of a home now stands at £260,828, 4.5% lower than the peak in August last year.

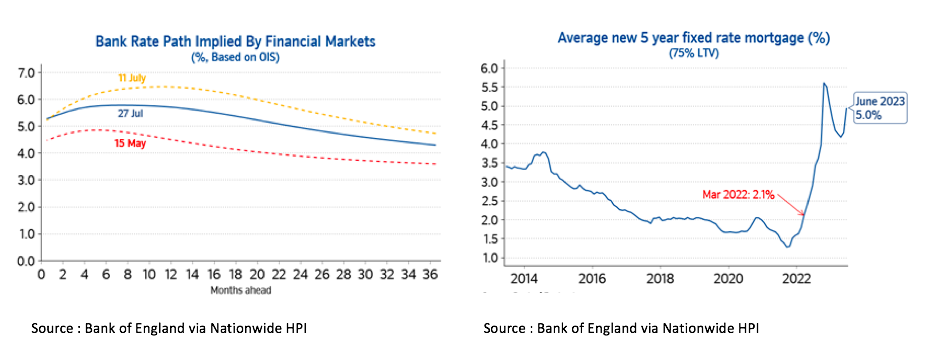

The Bank of England's successive interest rate hikes since December 2021 have led to soaring mortgage costs, making homeownership unaffordable for many. While some mortgage rates have been reduced by certain lenders, overall housing market activity has remained subdued, with completed housing transactions down by 15% compared to the previous year.

Despite the challenging affordability picture, experts believe a housing crash is unlikely as long as unemployment stays below 5%. Looking ahead, the hope is for improved housing affordability over time, especially if mortgage rates moderate once the Bank rate peaks.

As a result, housing affordability has reached a concerning level, especially for first-time buyers. For someone on an average wage aiming to purchase a typical first-time buyer property with a 20% deposit, monthly mortgage payments now consume 43% of their take-home pay, assuming a 6% interest rate. This represents a notable increase from 32% just a year ago and significantly exceeds the long-term average of 29%.

The subdued housing market activity, with 86,000 completed housing transactions in June, 15% below the same period last year, and around 10% below pre-pandemic levels, reflects the impact of these affordability challenges. While mortgage approval data showed a surge in activity in June, many of these applications were made before the recent rise in longer-term interest rates.

UK house prices plunge 3.8% YoY in July, fastest price drop in 14 years.

While the Nationwide chief economist Robert Gardner believes a housing crash is unlikely, subject to unemployment remaining below 5%, several leading economists are predicting further price declines. According to Gabriella Dickens, a senior economist at Pantheon Macroeconomics, an economic research consultancy in Newcastle upon Tyne, consumers' confidence remains significantly below its long-run average. The prevailing belief that house prices will continue to decline is firmly established. As a result, Dickens suggests that house prices may need to drop by approximately 8% from their peak to restore a balance between demand and supply in the market.

Meanwhile, UK homebuilder Taylor Wimpey Plc notes resilient home prices despite surging mortgage rates cooling demand. In the first half of the year, their average UK selling price rose 6.7% to £320,000, an improvement compared to the second half of 2022. However, the average weekly private net sales rate of 0.71 still falls short of the 0.9 average for the same period last year.

The uncertainty therefore surrounding the market's trajectory adds to the complexity and caution in the current property landscape. Looking forward, the hope lies in healthy rates of nominal income growth and modestly lower house prices, which could eventually improve housing affordability, especially if mortgage rates moderate after the Bank rate peaks. However, the delicate balance between interest rates, economic conditions, and buyer behavior remains pivotal in determining the future stability of the UK housing market.

Disclaimer: The views expressed above are based on industry reports and related news stories and are for informational purposes only . SSIL does not guarantee the accuracy, legality, completeness, reliability of the information and or for that of subsequent links and shall not be held responsible for any action taken based on the published information.